Debt Solutions Guide

Debt is the ultimate opportunity creator and problem-solving tool. Whether you want to buy your main home, an investment property in the UK or abroad, redevelop or invest in commercial property, finance luxury assets, borrow against your crypto or securities portfolio or raise debt for a business, Enness is here to help.

As a leading broker of million-pound-plus finance, we will negotiate a hand-built finance package for you that meets all of your needs. We are experts in high-value and international debt, and we can work with you or your advisers to arrange the deal so it is as efficient and streamlined as possible from a fiscal, financial and structuring perspective.

The more complex your financial background, situation and requirements, the more value we will add as a broker.

We work with UK residents, UK expats living abroad, foreign nationals, individuals with no existing credit footprint in the country where you want to use debt, individuals with sensitive and complex financial backgrounds, in transactions that use multiple asset classes, or if there are elements that make borrowing challenging through normal routes. We broker deals of a million pounds or more and we can arrange finance internationally and in cross-border deals. We regularly advise on very high-value deals and have brokered debt of £100 million plus.

2022 First Half Report

They say that time flies when you’re having fun, and there’s nothing more true to be said of our experience in the first half of 2022. There has been constant talk of the housing market cooling (no sign of it yet!), sliding markets, rising interest rates and,…

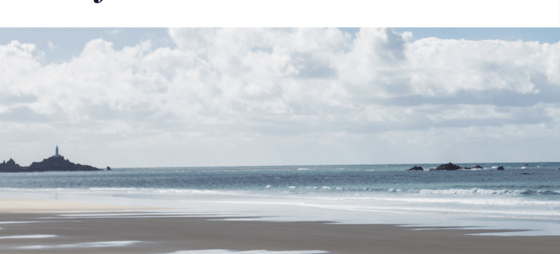

DOWNLOAD PDF NOWHow to Buy and Finance Property in Jersey

Enness is a leading broker of high-value property finance for anyone looking to buy property on Jersey. With an office and local team operating from St. Helier, we are uniquely positioned to help borrowers looking for Jersey mortgages. We work with anyone buying high-value…

DOWNLOAD PDF NOWHow to Buy and Finance Property in Switzerland

As one of the world’s leading brokers for high-value finance, Enness is uniquely positioned to source and negotiate mortgages and property finance for Swiss property acquisitions. We work with anyone buying high-value property in Switzerland, whether you are a resident…

DOWNLOAD PDF NOWPrivate Client Adviser Guide

As a private client adviser, you may regularly need to source diverse debt and finance solutions for your clients and prospects. You may not be able to handle these requests in-house, or you need the help of an expert partner like Enness to search the market and negotiate a…

DOWNLOAD PDF NOWHigh Net Worth Guide to UK Mortgages

The UK is home to one of the most liquid, competitive, and complicated mortgage markets in the world. There are hundreds of mortgage providers who lend in the UK, from major international banks to niche building societies and alternative lenders. Each lender has their own…

DOWNLOAD PDF NOWW11 Local Property Trends

Welcome to the Q1 2022 edition of the YOUhome Property Times in collaboration with Enness Global, an expert view on local property trends in W11. In this edition we look at data since 1995, analyse data from the past year and make projections for the coming year, laying out…

DOWNLOAD PDF NOWCorporate Finance Guide

Corporate finance comes in many shapes and forms. You can use it to unlock capital to grow your business, buy commercial property, purchase high-value business assets, or simply to access cash to overcome short-term liquidity challenges. Enness Global specialise in small and…

DOWNLOAD PDF NOWGuide to Securities-Based Lending

Securities-based lending provides ready access to capital. From purchasing a property, buying assets, investing in stocks or growing a business, you can use securities-backed lending (also known as Lombard loans) for various purposes. Securities-based lending can be an…

DOWNLOAD PDF NOWBridging Finance Guide

Bridging finance comes in many shapes and forms. You can take advantage of bridging finance if: You have complex or low income A significant portion of your wealth is tied up in assets like property You know banks and mainstream lenders won’t…

DOWNLOAD PDF NOWHow to Buy and Finance Luxury Property in Monaco

Monaco, a tiny sovereign state situated on the French Riviera, is often described as a “billionaires’ playground” for good reason. As well as being famous for the annual Formula One Grand Prix, the glamour of the Monte-Carlo Casino and home to some of the…

DOWNLOAD PDF NOWHow to Buy and Finance Luxury Property in London

The London property market is on fire at the moment, and we are pretty sure it will roar on for the next few years. Easy access to finance in London, the overall security of the UK and the strength of the country’s legal system all have enduring pulling power. London…

DOWNLOAD PDF NOWHow to Buy and Finance Luxury Property in France

France is one of the most popular property markets for foreign nationals: we are all aware of the chic appeal of Paris, the enduring allure of the Riviera in the summer or the freshness of the mountains in winter. However, buying a property in France, especially as…

DOWNLOAD PDF NOW